OTC, ENDEX, EPEX and EPTA

Last modified by Bart Verheecke on 2024/05/04 20:08

the difference between OTC (Over-The-Counter), ENDEX (European Energy Derivatives Exchange), EPEX (European Power Exchange), and EPTA (European Power Trading Association) lies in their function and structure in the energy market:

- OTC (Over-The-Counter): This refers to trading in financial instruments, such as shares, bonds, derivatives or commodities, that takes place directly between two parties' stock exchanges. OTC trading is less regulated and can involve more customized agreements

- ENDEX (European Energy Derivatives Exchange): This was an exchange where energy derivatives, such as options and futures on gas and electricity, were traded. ENDEX provided a regulated and transparent market for these instruments. However, this exchange has been taken over by ICE Endex, part of the Intercontinental Exchange.

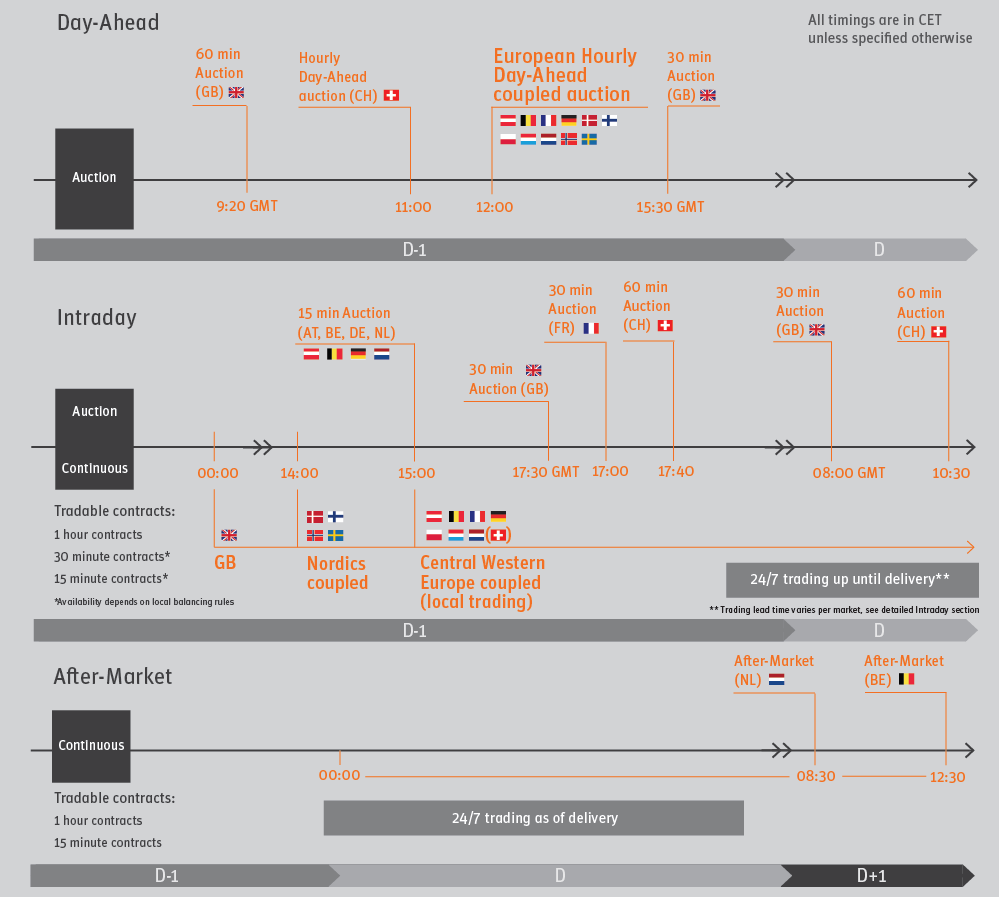

- EPEX (European Power Exchange): EPEX is an important electricity exchange in Europe and facilitates short-term electricity trading (daily and intraday markets). EPEX offers a transparent and regulated marketplace for electricity trading and plays an important role in the European energy market.

- EPTA (European Power Trading Association): This is not a trading platform, but a trade organization that represents the interests of companies active in electricity and gas trading in Europe. EPTA focuses on promoting fair and efficient energy markets and influencing regulations in the energy sector.

In short, OTC is a way of trading outside regulated exchanges, ENDEX is a specific exchange for energy derivatives (now part of ICE Endex), EPEX is an active electricity exchange, and EPTA is a trade association for energy traders.